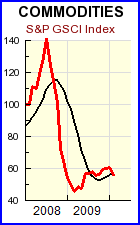

In December U.S. Treasuries, as measured by the Ryan 10-year Treasury Index, fell below their 10-month moving average. In January commodities, as measured by the S&P GSCI Index, did the same. U.S. stocks (S&P 500) are 7% off their highs, and foreign stocks (EAFE) are 8% off theirs. Another 7% and 5% respectively and we will sell those as well at the end of February.

Here are February's allocations:

- U.S. stocks: 20%

- Foreign stocks (EAFE): 20%

- REITs: 20%

- Cash: 40%